TOUGH BALANCING ACT AS LAWMAKERS MOVE TO CONSIDER MEASURES TO FUND THE 2023/2024 BUDGET

The past week has been a busy one for the Departmental Committee on Finance and National Planning which Monday, wound up phase one of public hearings on the Finance Bill, 2023. After receiving submissions and memoranda for eight-straight days from organised groups and individuals on various proposals contained on the Bill, the Committee which took a brief hiatus to conduct approval hearings and vetting for the nominee to the position of Central Bank Governor, is now scheduled to hold a Mwananchi forum on the Bill in Parliament.

This Bill come in the wake of diminishing revenues owing to the country’s debt burden, a huge wage bill among other competing national priorities. The Finance Bill, 2023 provides for "Ways and Means" of financing the 2023/24 Budget. Section 39 of the Public Finance Management (PFM) Act requires a balance between Budgeting and Revenue raising. This implies that, should there be any reduction in the proposed tax measures, the House will also have to cut the proposed Budget proportionally.

According to the Tabled Budget Estimates, the proposed total expenditure and net lending for the FY 2023/24 is Kshs. 3,599.29 billion, representing a 6.4% (Kshs. 215 billion) expenditure increase relative to the 2022/23 Budget. Over the last decade, the historical average annual increase in total expenditure and net lending has been about 12%. Therefore, it is evident that, this year, the National Treasury has maintained the Government’s fiscal consolidation efforts by limiting expenditure growth

Moreover, statistics from the National Treasury show that Kenya’s tax revenue collection as a share of GDP has stagnated at around 15 percent over the last decade. Consequently, Kenya has lagged behind other comparable African countries whose tax revenue collection is between 20 percent and 25 percent.

For instance, ordinary revenue as a share of gross domestic product (GDP) declined from around 16.2% in 2013/14 FY to around 15% in 2021/22 FY. One of the drivers of the decline in ordinary revenue collection as a share of economic output was the one percentage point decline (from 7.9 percent to 6.9 percent) of income tax collection as a share of GDP. The performance of income tax which accounts for around 46 percent of ordinary revenue collection will have a significant impact on future tax revenue prospects.

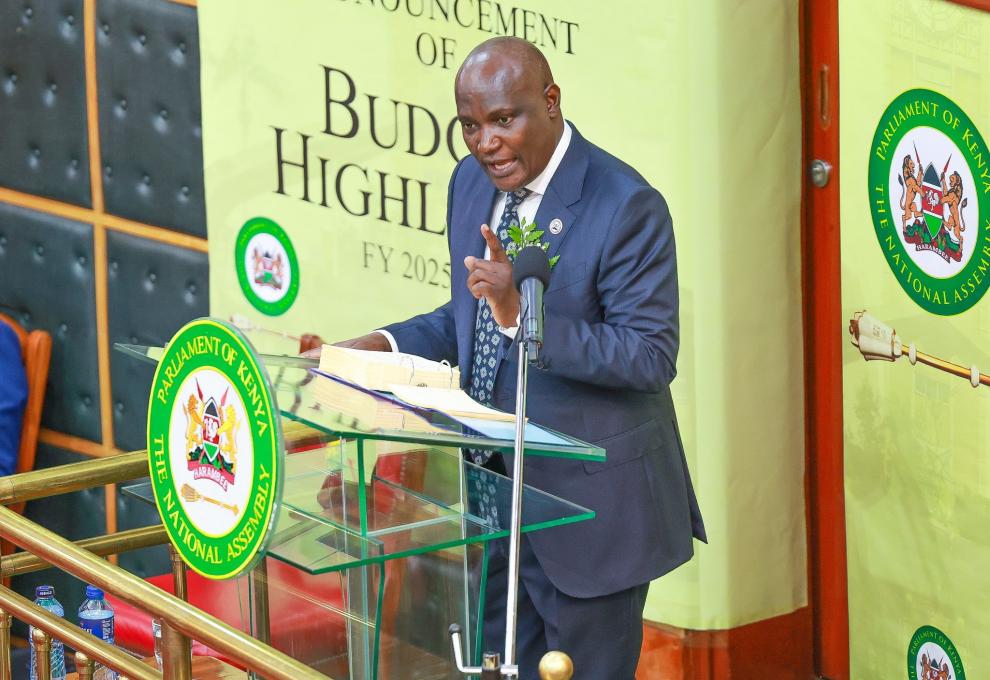

The Committee has not been shy of asserting these facts to the over 180 respondents who appeared before them to file their oral submissions. Last week, the Committee’s Chairperson Hon. Kimani Kuria underscored the fact that the country has to grow revenues to not only seal the deficit gap, but to also help fund the government programs and meet other government obligations.

“We all live in this country and are aware of the dire economic situation the country is in. We all have to agree to provide solutions to our current fiscal challenges ”, the chairman told the stakeholders.

He told the stakeholders that the ripple effect that would emanate from for instance, from the proposed National Housing Development Fund is great, given the jobs that the program is set to create, and the demand for inputs the program would create for the manufacturing sector. He wondered why a number of stakeholders had not supported the provision despite its projected impact. This provision among others that that received little focus during the public hearings are however likely to be the game changers in the efforts to support the 2023/2024 budget.

Among the strategies that the Bill proposes to shore up revenues to jump start the county out of its financial rut, is the expansion of the tax base. The Bill seeks to amend Section 2 of the Income Tax Act (Cap.470) to raise taxes from income earned by digital content creators. The transfer of digital assets is also set to attract a tax at 3 per cent of the transfer value. In another move to expand the tax base, those involved in the digital market place will be now be required to register along other entrepreneurs .

Through another provision, the Bill also proposes to amend Section 12(c) of the Income Tax Act to have turn-over tax paid by businesses with an annual turn-over of between Kshs. 500,000 and 15,000, 000. This move is geared towards netting more Small Medium Entrepreneurs (SMEs) to the tax bracket. Currently only businesses with an annual budget turnover of between 1,000,000 and Kshs. 50,000,000 have been paying turnover tax.

Even as the government moves to effect additional taxpayer enrollment in to its system, it is the proposed amendment of Section 16 (a) of the Income Tax act to enforce the use of the electronic tax invoice management system that could provide the necessary impetus to reduce revenue leaks and bolster collection without increasing taxation.

In a bid reduce the country’s medicare burden for retired senior citizens in the future, the Bill proposes to provide for insurance relief to post-retirement medical fund contributors. The contribution which is voluntary just like the proposed National Housing Development Fund, will not only generate the much needed revenue by the government, but will also be supplementing government’s plan on health insurance.

As the Committee on Finance sits to scrutinize these provisions, the legislators will also be expected to consider the proposed amendment of Tax Procedures Act to allow the Cabinet Secretary for Health to exempt supplies of goods for the direct and exclusive use in the construction and equipping of specialized hospitals with a minimum bed capacity of one hundred. This is geared toward promoting the construction of hospitals ; a key part of the implementation of Universal Healthcare.

Another move that is likely to make the tax regime more progressive is the proposed imposition of income tax at 35 per cent for any income worth over Kshs. 500,000. The government says this move is in line with economic principles of equitable taxation which requires that the tax burden reflects the ability to pay.

In a bid to encourage landlords to comply with the payment of rental taxes, legislators will be considering amending the Third Schedule of the Income Tax Act to reduce the tax on rental income from 10 per cent to 7.5 per cent.

The Bill also proposes a raft of incentives. Key among this is the proposed exemption of input for pharmaceutical manufacturing and agricultural pest control in a bid to promote local manufacturing.

Further, the proposed exemption of inputs or raw materials locally purchased or imported by manufacturers of fertilizer, liquid petroleum gas and all teas sold for purposes of value addition if approved by the House, is also expected to significantly address the cost of living while guaranteeing food security.

In a move to protect the local fish industry, legislators will be considering if to allow the proposed imposition of excise duty on imported fish at Kshs. 100,000 per metric tonne. In the same vein, Members will be considering the proposed move to protect the local cement and furniture producers with the proposed imposition of excise duty on imported cement and furniture.

Further, the proposed reduction of excise duty on telephone and internet services from 20 per cent to 15 per cent, and that of bank money transfer services from 20 per cent to 15 per cent, will also likely help the cost of business operations down.

In a bid to address the negative externalities of betting and gaming, the lawmakers are set to consider the proposed increase on excise duty on betting, gaming, lotteries and prize competition from 7.5 per cent to 20 per cent.

After undertaking public participation on the Bill as required by law, the Departmental Committee on Finance and National Planning is now expected to engage the National Treasury and the Kenya Revenue Authority on some of the fundamental issues raised by respondents before retreating to write its report. The Report is expected to be tabled when the House resumes from recess early June for consideration.

The Bill has a timeline of approval of 30th June, 2023, which coincides with the enactment of the Appropriation Law, 2023. This is in line with the provisions of the Public Finance Management Act, 2012 as amended in 2019, to allow the Finance Bill be applied by 1st July of each Financial Year.