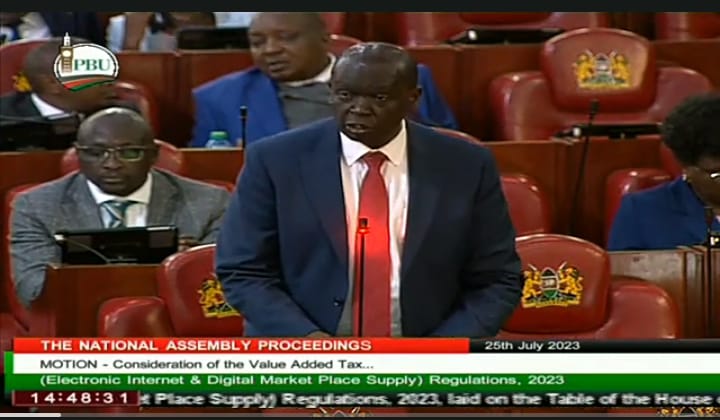

𝐇𝐎𝐔𝐒𝐄 𝐀𝐏𝐏𝐑𝐎𝐕𝐄𝐒 𝐑𝐄𝐆𝐔𝐋𝐀𝐓𝐈𝐎𝐍𝐒 𝐎𝐍 𝐃𝐈𝐆𝐈𝐓𝐀𝐋 𝐓𝐀𝐗𝐀𝐓𝐈𝐎𝐍

The National Assembly has approved the Value Added Tax (Electronic Internet and Digital Market Supply Regulations) 2023.

This approval effectively amends the existing Value Added Tax (VAT) Regulations initially published in 2020, with new requirements for the taxation of electronic, internet and electronic marketplace supplies.

The Regulations published by the National Treasury in March 2023, will guide on taxations relating to electronic, internet and digital marketplace supplies including downloadable digital content such as mobile applications, ebooks and films. Other targeted digital contents include software programs, drivers, website filters and firewalls among others.

Chairperson of the Committee on Delegated Legislation Hon. Samuel Chepkonga (Ainabkoi) told the House that the new Regulations would provide the proper legal framework to allow the Government raise additional revenue to finance its development agenda.

"Most businesses have migrated from the real world to the digital space, which as a consequence has resulted in more people trading on the icloud. Unfortunately, most investors doing business electronically have not been paying tax," said Hon. Chepkonga.

Hon. James Nyikal (Seme) said the new regulations are strategic in courting more external investors.

"This is actually a good idea because e-business in the new international business model and alot of trade is being done through electronically," said Hon. Nyikal.

Other Members said the new Regulations would expand the Government Revenue base, and avail more resources which can be redeployed in strategic expansion of the country's digital space.