𝐍𝐀𝐓𝐈𝐎𝐍𝐀𝐋 𝐀𝐒𝐒𝐄𝐌𝐁𝐋𝐘 𝐂𝐎𝐌𝐌𝐈𝐓𝐒 𝐁𝐔𝐒𝐈𝐍𝐄𝐒𝐒 𝐋𝐀𝐖𝐒 (𝐀𝐌𝐄𝐍𝐃𝐌𝐄𝐍𝐓) 𝐁𝐈𝐋𝐋 𝐓𝐎 𝐂𝐎𝐌𝐌𝐈𝐓𝐓𝐄𝐄𝐒 𝐅𝐎𝐑 𝐑𝐄𝐕𝐈𝐄𝐖

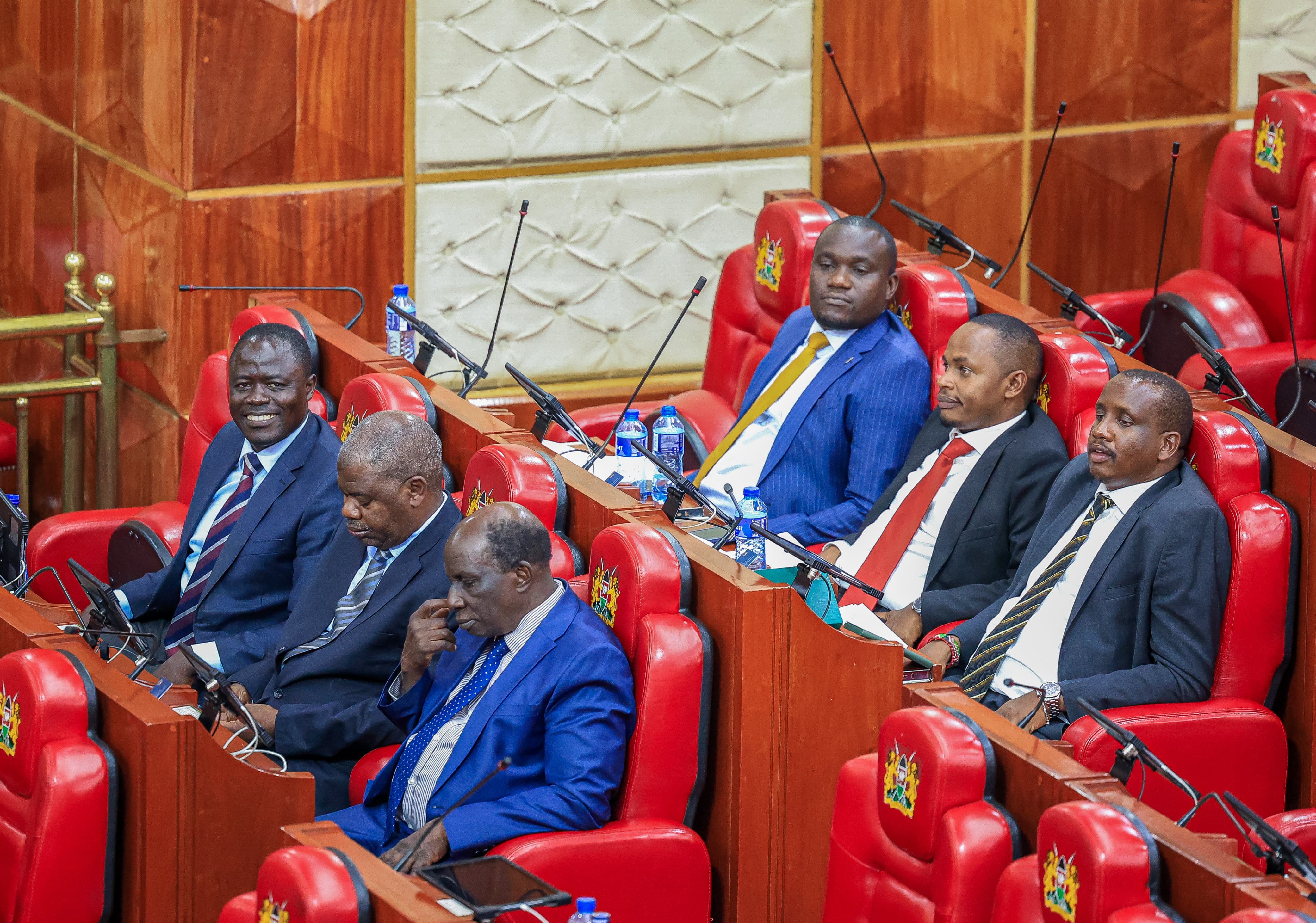

The Business Laws (Amendment) Bill, 2024 has been committed to two departmental Committees for consideration and public participation following its First Reading on 13th November 2024.

The Bill, sponsored by the Leader of the Majority Party, Hon. Kimani Ichung’wah, seeks to amend nine Acts of Parliament to enhance regulatory oversight, streamline processes, and promote economic stability.

The proposed amendments of the Business Laws (Amendment) Bill, 2024 affect the Banking Act, Central Bank Act, Microfinance Act, Standards Act, Kenya Accreditation Service Act, Scrap Metal Act, Special Economic Zones Act, Kenya Industrial Research and Development Institute Act, and the National Electronic Single Window System Act.

Speaker of the National Assembly, Hon. Moses Wetang’ula, directed specific provisions of the Bill be allocated to two departmental Committees in line with their mandates. The Committee on Finance and National Planning will consider sections of the Bill concerning the Banking Act, Central Bank Act, and Microfinance Act.

“I hereby direct the Departmental Committee on Trade, Industry and Cooperatives will deal with the provisions of the Bill relating to The Standards Act, Cap. 496, the Kenya Accreditation Service Act, Cap. 496A, the Scrap Metal Act, Cap. 503, the Special Economic Zones Act, Cap. 517A, the Kenya Industrial Research and Development Institute Act, Cap. 511A; and the National Electronic Single Window System Act, Cap. 485D,” added Speaker Wetang’ula.

The lead Committee, Finance and National Planning, is tasked with consolidating a report to table in the House before the Second Reading.

The Business Laws (Amendment) Bill, 2024 proposes to expand the Central Bank of Kenya (CBK) regulatory mandate to include non-deposit-taking credit providers such as digital lenders, peer-to-peer lenders, and credit guarantee businesses. This measure aims to promote fair practices, ensure financial stability, and enhance consumer protection through licensing, credit information sharing, and stricter oversight.

Additionally, the Bill transfers oversight of non-deposit-taking microfinance businesses from the Microfinance Act to the CBK Act. The shift introduces new requirements for transparency, including the disclosure of all credit costs and borrower rights. A six-month transition period is proposed for affected businesses to comply.

Under the Banking Act, the amendments seek to improve financial sector resilience. These include stiffer penalties for institutions violating CBK guidelines and a phased increase in minimum core capital requirements. Banks and mortgage institutions will be required to meet a core capital threshold of Ksh 1 billion by the end of 2024, progressively rising to Ksh 10 billion by 2027. The phased approach will attract global investors while allowing local banks time to adapt.

The Committee on Finance and National Planning and Committee on Trade, Industry and Cooperatives will engage stakeholders for public participation and prepare a Report for consideration by the National Assembly.