𝐂𝐒 𝐌𝐁𝐀𝐃𝐈 𝐏𝐑𝐄𝐒𝐄𝐍𝐓𝐒 𝐊𝐒𝐇 𝟒.𝟐𝟑𝟗 𝐓𝐑𝐈𝐋𝐋𝐈𝐎𝐍 𝐁𝐔𝐃𝐆𝐄𝐓 𝐓𝐎 𝐌𝐏𝐒, 𝐏𝐋𝐀𝐍 𝐓𝐀𝐑𝐆𝐄𝐓𝐒 𝐓𝐎 𝐂𝐑𝐄𝐀𝐓𝐄 𝐉𝐎𝐁𝐒, 𝐋𝐎𝐖𝐄𝐑 𝐂𝐎𝐒𝐓 𝐎𝐅 𝐋𝐈𝐕𝐈𝐍𝐆 𝐀𝐍𝐃 𝐓𝐀𝐌𝐄 𝐏𝐔𝐁𝐋𝐈𝐂 𝐃𝐄𝐁𝐓

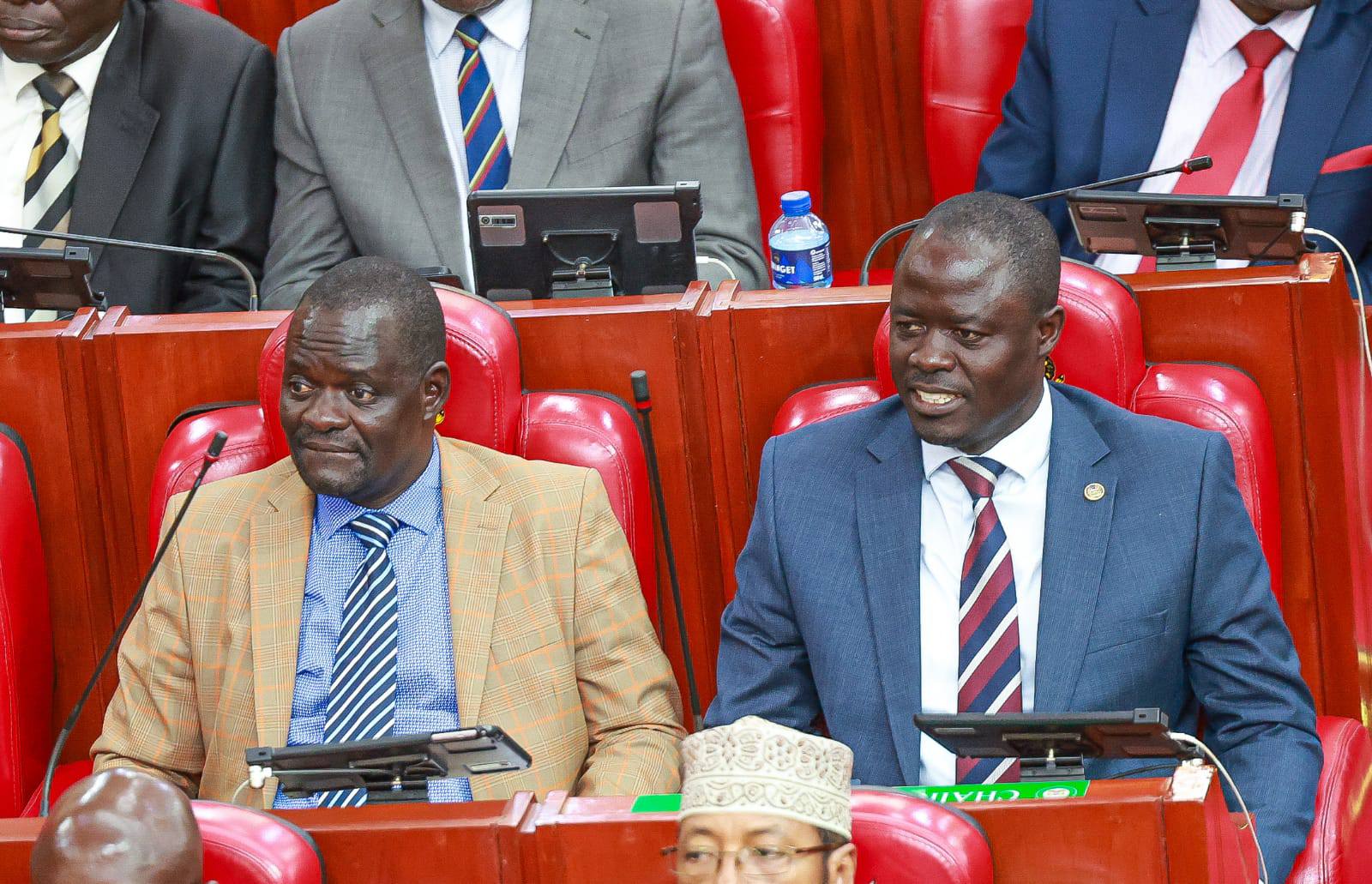

Cabinet Secretary for National Treasury and Economic Planning Hon. John Mbadi today presented a Ksh 4.2 trillion spending plan for the 2025/26 financial year, vowing to put Kenyans at the heart of fiscal policy and stimulate sustainable economic recovery through job creation, affordable healthcare, housing, and food security.

Themed “Stimulating Sustainable Economic Recovery for Improved Livelihoods, Job Creation, and Business and Industrial Prosperity in line with the Bottom-Up Economic Transformation Agenda (BETA),” the budget comes amid growing concerns over rising public debt, cost of living, and economic inequality.

“This budget speaks to the aspirations of ordinary Kenyans. It’s about restoring hope, expanding opportunity, and strengthening the resilience of our economy,” said Mr. Mbadi said as he presented his maiden budget statement in a packed National Assembly Chambers.

To cushion low-income earners and revive grassroots productivity, CS Mbadi proposed robust investments in key BETA pillars.

He allocated Ksh 47.6 billion to the agriculture sector, including Ksh 8 billion for fertilizer subsidies, which he said had already reduced fertilizer prices by 67 percent and increased maize production by 38.9 percent in two years.

On health, the CS allocated Ksh 138.1 billion to accelerate the roll-out of Universal Health Coverage. Notably, over 22 million Kenyans are now registered under the new Social Health Authority (SHA), up from 8 million previously covered by NHIF.

“We are not just building clinics. We are rebuilding trust in public healthcare,” Mr. Mbadi said, citing a 175 percent b increase in health insurance enrolment.

A further Ksh 128.3 billion will go towards the Affordable Housing Programme, with over 2,300 units completed and 11,000 nearing completion across four counties. CS Mbadi revealed that more than 250,000 jobs have already been created in the housing sector alone.

To support small businesses and youth employment, the Treasury has disbursed over Ksh 71 billion through the Hustler Fund to 26 million borrowers, with a repayment rate of 79%. An additional Ksh 300 million has been earmarked for the fund in the new fiscal year.

The government also announced the expansion of the Climate WorX programme, a social job creation scheme targeting over 110,000 youth to engage in environmental restoration, slum clean-ups, and infrastructure development across all 47 counties.

“Through Climate WorX, we’re giving young people income, dignity, and purpose,” CS Mbadi said.

Keenly aware of Kenya’s swelling public debt, now at 63% of GDP, Mbadi pledged to slow down borrowing by implementing a fiscal consolidation plan and reducing the fiscal deficit from 5.7 percent to 4.8 percent of GDP.

“Kenyans are rightly concerned about transparency in public debt. That’s why I have requested the Auditor General to conduct a comprehensive audit,” he said.

He also announced a raft of governance reforms including the rollout of a nationwide e-procurement system from July 1, 2025, and zero-based budgeting to curb wastage.

The government will also migrate all ministries and agencies to a Treasury Single Account to tighten cash management.

To boost confidence in the budget process, the Treasury CS emphasized enhanced public participation, noting that input from “Bunge la Mwananchi” forums in Jevanjee Gardens and county barazas directly shaped the budget’s direction.

In the education sector, the CS unveiled a massive Ksh 702.7 billion allocation. This includes Ksh 387.2 billion for the Teachers Service Commission and Ksh 7.2 billion for the recruitment of intern teachers.

The government is also introducing cost-sharing reforms in exam funding to ensure efficiency and target support to vulnerable learners.

On ICT, CS Mbadi committed Ksh 12.7 billion to the digital superhighway and creative economy, including the development of digital hubs, the Konza Technopolis, and digitization of government services.

“We now have over 20,000 digitized services on eCitizen. This is not just a digital revolution. It is a service revolution,” CS Mbadi declared.

In response to the uproar over the withdrawn Finance Bill 2024, CS Mbadi promised a more inclusive, less punitive tax regime. The Kenya Revenue Authority will focus on expanding the tax base and using technology including AI-driven compliance systems to capture revenues from informal and digital sectors.

“We are shifting from taxing the few heavily, to taxing many fairly,” CS Mbadi explained.