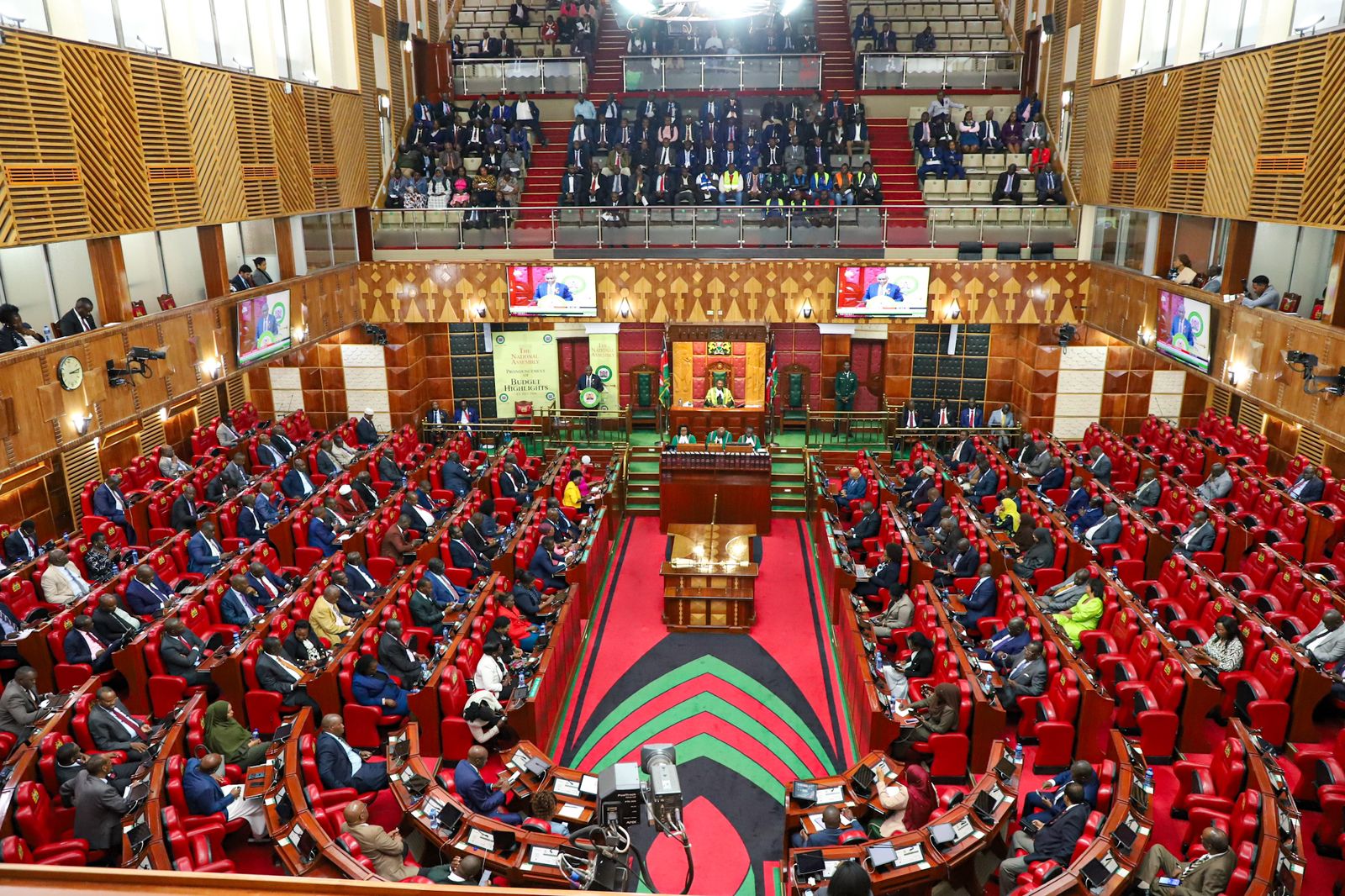

𝐍𝐀𝐓𝐈𝐎𝐍𝐀𝐋 𝐀𝐒𝐒𝐄𝐌𝐁𝐋𝐘 𝐀𝐃𝐎𝐏𝐓𝐒 𝐅𝐎𝐔𝐑𝐓𝐇 𝐑𝐄𝐕𝐄𝐍𝐔𝐄 𝐒𝐇𝐀𝐑𝐈𝐍𝐆 𝐅𝐎𝐑𝐌𝐔𝐋𝐀

The National Assembly has adopted the Fourth Basis for the Annual Allocation of the Share of National Revenue to County Governments for the Financial Years 2025/2026 to 2029/2030, concurring with the Senate's recommendations.

Moving the Motion, Chairperson, Budget and Appropriations Committee, Hon. Samuel Atandi (Alego Usonga,) emphasized the significance of this fourth formula since the promulgation of the new Constitution, noting that a new formula is developed every five years to guide the allocation of national revenue to counties. "Many parameters have been used in the past when considering the allocation and sharing of these resources among counties," Hon. Atandi stated.

The proposed formula introduces two tiers of allocation based on the "County Equitable Share” The formula relies on the Population Index (based on the 2019 Kenya Population and Housing Census), Equal Share Index, Poverty Index (based on the 2022 Kenya Poverty Report by KNBS), and Geographical Size Index.

A key feature of the fourth formula is the special allocation to 12 identified counties: Elgeyo Marakwet, Embu, Isiolo, Kirinyaga, Laikipia, Lamu, Nyamira, Nyandarua, Samburu, Taita Taveta, Tharaka-Nithi, and Vihiga. These counties are earmarked for additional funding to catalyze development projects, with an expected Ksh 4.46 billion to be shared among them when the equitable share reaches Ksh415 billion or above.

This targeted allocation, Hon. Atandi explained, stems from the recognition that these counties have struggled to undertake development projects due to their size and previously inadequate resource allocation. "This formula will ensure that counties which have not engaged properly in development programmes will now have an opportunity to do so," he affirmed.

Hon. Atandi pointed out the challenge with the population parameter, noting that census data is not regularly updated, making it difficult to accurately estimate current populations for resource allocation. He urged for more frequent population censuses in the future.

Speaking on the Poverty Index Hon. Atandi revealed, “Some counties have refused to develop or improve their poverty levels since they are sure that this parameter will be used to give them resources.” He advocated for a reduced emphasis on this parameter going forward to incentivize development. Similarly, the health status of counties, though a consideration for resource allocation, has led to some counties allegedly neglecting to improve health services to continue receiving more funds.

Seconding the Motion, Hon. (Dr) Robert Pukose (Endebess) lauded the collaborative effort between the National Assembly and the Senate in developing the formula. He expressed hope that the increased allocation, particularly for counties like Taita Taveta and Elgeyo-Marakwet, would translate into tangible development. However, he also voiced concerns about the misappropriation of funds, stating, "It will be a shame if this House appropriates funds and agrees with this formula and then the money ends up in people’s pockets."

While largely supportive of the formula, several lawmakers raised critical questions regarding its effectiveness and the broader issue of fiscal responsibility at the county level.

Hon. (Dr) Ojiambo Oundo (Funyula) asked for clarity on whether it was based on population, poverty index, or other social parameters. He also underscored the historical marginalization of certain regions.

Hon. Oundo advocated for the inclusion of fiscal discipline as a criterion in future formulas. He argued that dropping this criterion "is giving the counties a blank cheque to continuously misappropriate and misuse public resources and, generally, make them lazy not to pursue their own source revenue."

Hon. Silvanus Osoro (South Mugirango) echoed concerns about county governments' own-source revenue generation and expenditure, particularly highlighting counties like Nairobi. "Looking at Nairobi, for example, as a county, the amount of money it collects as own source revenue is enough to fund up to five counties by itself," he asserted.

Hon. Osoro called for legislation to govern county expenditures, similar to the National Government Constituencies Development Fund (NG-CDF). He proposed that "not more than 60 per cent of the amount should be used for recurrent expenditure or salaries," and that money should be allocated with "particular votes" to ensure it reaches the grassroots.

Hon. Gideon Ochanda (Bondo) emphasized the need for a more comprehensive approach to revenue sharing, urging consideration of constitutional provisions beyond just population, poverty, and geographical size. He pointed to Article 203(1)(d) of the Constitution, which mandates ensuring counties can perform their allocated functions. "When looking at the allocation of revenue to counties, who has ascertained or computed the county functions and their value before we allocate them resources?" he questioned.

Hon. Ochanda also highlighted concerns about additional funding and grants to counties, arguing that these are often overlooked when determining horizontal resource allocation, potentially leading to double allocations for some counties.